CHANGES TO SALES TAX COLLECTION

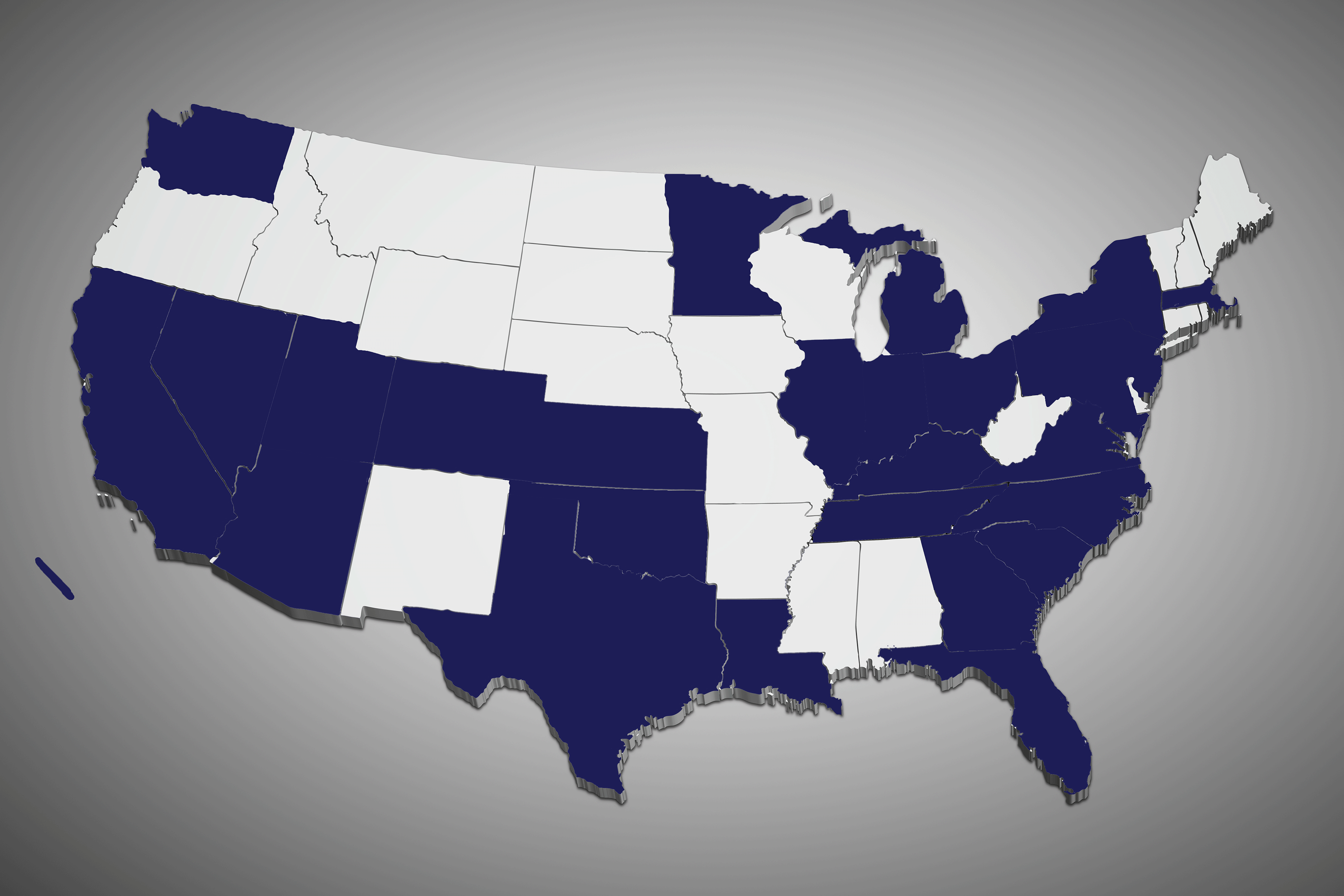

As an Illinois-based business, Hawk Research Laboratories, LLC (“Hawk Labs”) has always been required by law to collect sales tax for Illinois transactions. Due to a U.S. Supreme Court ruling in 2018, the law now requires companies, including Hawk Labs, to begin assessing and collecting sales tax for transactions shipping to the following states: Arizona, California, Colorado, Florida, Georgia, Hawaii, Illinois, Indiana, Kansas, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Nevada, New Jersey, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, South Carolina, Texas, Tennessee, Utah, Virginia, Washington, Wisconsin.

Beginning March 1, 2019, Hawk Labs implemented the process of adding the appropriate sales tax (based on zip code) to each invoice that is shipping into one of these states. As Hawk Labs becomes responsible to collect sales tax for additional states, we will commence charging the appropriate sales tax. To determine the sales tax rate Hawk is required to collect from you, enter your zip code in this sales tax locator.

Commencing October 1, 2025, Hawk will begin collecting sales tax for Kentucky and New York.

WHAT DOES THIS MEAN FOR HAWK LABS CUSTOMERS?

If you are located in one of the effected states, or if Hawk Labs ships products on your behalf to one of these states, Hawk Labs is legally required to charge sales tax on purchases by our customers.

For example, if your business is located in Florida and Hawk Labs ships products to a location in Georgia for a project you will do there, then Hawk Labs is obligated to collect sales tax on the materials shipped to Georgia.

If a customer in the impacted states has been filing and paying Use Tax according to their local tax regulations, Hawk Labs is now required to collect sales tax instead. Those customers will then no longer be required to file and pay the local Use Tax.

If a Hawk Labs customer in the impacted states is charging sales tax to their customers (for example, a consumer, hotel or property manager) on their products and/or services, then Hawk Labs does not need to collect sales tax, as local sales taxes are already being paid by Hawk’s customer. Hawk’s customers must submit to Hawk Labs a copy of their state-issued resale certificate, also known as a tax exemption certificate, which allows Hawk’s customers to buy goods without Hawk collecting local sales tax. The customer is then solely responsible for submitting state and local tax returns. A business owner can typically apply for a resale certificate with their state tax department but it is only valid for purchases shipped to that state.

Customers can also expect to see other suppliers who meet the threshold criteria to collect sales tax in the impacted states starting to charge state sales tax as a result of this change in regulations.

Non-payment of use or sales tax can have serious financial consequences. Tax auditors can calculate or estimate tax payments due going back many years, as there is no statute of limitations on audits and no limit on the lookback period. This can amount to a significant back-tax bill plus fees and penalties.

If you need further assistance in understanding the changes in the tax code, please click on the link below to access a list of phone numbers for your state tax representative.

Have additional questions?

- Click here to download responses to Frequently Asked Questions

- Contact your state tax representative

- Speak to your local tax advisor for additional information